General

Bitcoin Halving: countdown to a long-awaited impact

The next Bitcoin halving is scheduled to happen on April 18th, marking the beginning of the expected Bull Market!

Experts believe that this year holds positive factors that will drive BTC to new all-time highs (ATH).

How does halving work exactly?

- Bitcoin’s halving takes place when block rewards for miners on the Bitcoin blockchain are halved to reduce the number of new coins entering the network.

- The halving reduces the amount of new bitcoins generated per block, implying a lower supply of new bitcoins. In normal markets, a lower supply along with stable demand usually leads to higher prices.

- Bitcoin’s halving helps manage Bitcoin’s inflation rate by controlling the supply, fixed at 21 million bitcoins. This mechanism curtails the flow of new coins into circulation, ensuring scarcity and preventing devaluation.

- Every four years, the number of block rewards is halved. The day the quantity is halved is called the “halving”.

- The countdown is already underway, with less than 100 days remaining. The bullish forecast for the price of BTC and cryptocurrencies in 2024 is one of the most optimistic in history.

- Significant events, such as the U.S. presidential elections and, most importantly, the approval of Exchange Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC), are expected to bring institutional investment into BTC worth billions of dollars.

![]() The halving occurs every 210,000 blocks. The initial Bitcoin block reward was 50 BTC. Currently, the block reward is 6.25 BTC, and after the next halving, the block reward will be 3.125 BTC.The 2020 halving occurred at block 630,000, and the 2024 halving is set to happen at block 840,000. The 21 million BTC will be fully mined by the year 2140; however, 98% of cryptocurrencies will be mined by 2030.

The halving occurs every 210,000 blocks. The initial Bitcoin block reward was 50 BTC. Currently, the block reward is 6.25 BTC, and after the next halving, the block reward will be 3.125 BTC.The 2020 halving occurred at block 630,000, and the 2024 halving is set to happen at block 840,000. The 21 million BTC will be fully mined by the year 2140; however, 98% of cryptocurrencies will be mined by 2030.

- This 2024 halving is special, with predictions suggesting that Bitcoin could surpass $100,000 by the end of the year, and even more optimistic estimates placing the cryptocurrency’s market capitalization at over $200,000.

- Cryptocurrency investors and analysts are closely watching Bitcoin’s price trend, looking for clues on how it might react this time. This anticipation may lead to an increase in buying activity as investors seek to capitalize on potential post-halving price increases. However, significant volatility could also arise, as expectations vary, and not all investors interpret the effects of the halving in the same way.

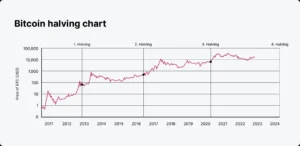

Bitcoin halving history (Source: bitpanda.com)

The history of halving

- In the past, Bitcoin halving have triggered notable increases in BTC prices and broader cryptocurrency growth, fostering increased investment across the market.

- Significant changes in miner rewards and cryptocurrency prices have occurred during previous Bitcoin halving. The first halving took place in 2012, reducing the block reward from 50 BTC to 25 BTC. At that time, the price of Bitcoin experienced a significant surge, reaching a historic high of around $30 before the event.

- The second halving occurred in 2016, reducing the block reward to 12.5 BTC. In this case, the price of Bitcoin also rose, reaching its historic high at that time of around $2,250 approximately a year after the halving.

- The most recent halving occurred in May 2020, reducing the reward to 6.25 BTC per mined block. Subsequently, the price of Bitcoin experienced a significant increase, reaching a record price of around $29,000 at the end of that same year.

How could the halving affect the market?

The upcoming Bitcoin halving is one of the most anticipated events in the crypto calendar. It could have a huge impact on the price of Bitcoin and the overall market landscape, even during the countdown period. Here’s why:

- Scarcity: The finite supply of Bitcoin makes it an attractive proposition for potential investors. As the halving increases scarcity, the appeal of Bitcoin as an investment is likely to grow.

- Market Psychology: In the lead-up to the halving, scarcity and anticipation of the event could trigger strong positive sentiment in the market and price movements.

- Mining Impact: As block rewards become less significant, some miners may cease operations as they become unprofitable due to rising costs. The potential decrease in hash rate could influence the price of Bitcoin.

Investment Strategies

As the halving approaches, many cryptocurrency investors are looking to adjust their strategies to maximize potential opportunities. Some of these strategies may include:

Early Buying: Expecting the market to behave similarly to previous halvings, with significant price increases, some investors choose to buy Bitcoin before the event, hoping its value will rise afterward. This has already occurred, with a 67% increase in the last six months.

Diversification: While the halving may positively affect Bitcoin, diversifying into other cryptocurrencies or assets can help mitigate risks, especially as the halving could introduce volatility to the market. Additionally, if the halving proves successful, confidence in Bitcoin may also strengthen confidence in other cryptocurrencies, increasing their value.

Technical and Fundamental Analysis: leading experts recommend using technical analysis as well as fundamental analysis tools to make more informed decisions, monitoring indicators such as hash rate, transaction volume, and overall market sentiment.

Long-Term Strategy: Some investors prefer to take a long-term approach, holding their Bitcoin investments beyond the halving and avoiding decisions based on short-term movements.