General

High and Low Price Impact. Understand it with DEXTools

- Today we will talk about a very important one for DeFi trading: the price impact, both high and low.

- We have been explaining some of the best strategies for DeFi trading, as for example in this recent article.

- But it is also important to be familiar with the concepts necessary for your strategy to work well!

Understanding Price Impact

- Price impact refers to the effect a trade has on the token’s price due to liquidity, trade size, and the market environment. Understanding price impact is essential for successful trades and minimizing costs.

- Here, we’ll discuss what high and low price impacts are, show how DEXTools can help monitor them, and explore specific use cases.

![]() In simple terms, price impact measures how much the execution of a trade will change the price of a token. When you place a trade, especially in a decentralized market where liquidity might be limited, buying or selling large amounts can shift the token’s price. The degree of this shift is the price impact.

In simple terms, price impact measures how much the execution of a trade will change the price of a token. When you place a trade, especially in a decentralized market where liquidity might be limited, buying or selling large amounts can shift the token’s price. The degree of this shift is the price impact.

- DEXTools provides traders with real-time insights, allowing them to gauge and minimize this effect.

High Price Impact

- A high price impact occurs when the trade size is large relative to the available liquidity in the pool, causing the price to shift significantly. This impact often leads to a worse price than expected, and if traders don’t pay attention, they may end up spending much more (or receiving much less) than anticipated.

- For example, let’s say a trader wants to buy $10,000 worth of a low-liquidity token. Due to limited supply in the liquidity pool, this transaction could push the token price up by, say, 10%, meaning the trader will actually receive fewer tokens than they would have with no price impact.

- High price impact is common with new or low-volume tokens. In these cases, large trades create noticeable fluctuations, making it important for traders to carefully monitor price impact.

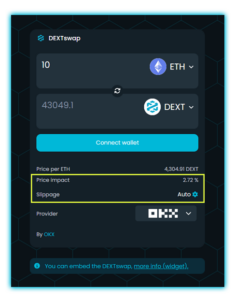

![]() Traders can check the Slippage on DEXTools to see how the trade size affects price and set limits to avoid unexpected losses.

Traders can check the Slippage on DEXTools to see how the trade size affects price and set limits to avoid unexpected losses.

Low Price Impact

- In contrast with High Price Impact, a Low Price Impact happens when the trade size is small relative to the liquidity in the pool. Here, the token price remains mostly stable, and the trader is likely to receive close to the expected amount of tokens. Low price impact is typical for well-established tokens with high liquidity.

- Consider a trader who buys $100 worth of ETH on Uniswap, where the ETH liquidity pool is massive. This small transaction barely affects the token price, resulting in a low price impact and ensuring the trader gets nearly the exact market price.

How DEXTools Helps Manage Price Impact

- DEXTools simplifies trading by providing tools to track price impacts, analyze token liquidity, and monitor real-time data for various tokens across multiple DEXs. For instance, when evaluating a trade, users can see liquidity pools, historical price data, and slippage estimates, all of which help in making informed decisions.

Liquidity on DEXTools

Real-World Use Cases on DEXTools

Preventing Losses on New Tokens:

- When a new token launches, its liquidity is often low, leading to high price impact on larger trades. DEXTools alerts traders to this by showing the expected price impact before they complete the transaction. A user could split their trade into smaller parts or wait for liquidity to increase, minimizing their loss.

Tracking Liquidity for Better Entry Points:

- Experienced traders on DEXTools often watch liquidity pool data to predict the impact of future trades. For example, if a liquidity provider adds significant funds to a token’s pool, the price impact on trades will decrease. Traders can use this information to time their trades better.

Setting Slippage Tolerance:

- DEXTools allows users to set slippage tolerance levels, helping them avoid high price impacts that might arise from sudden market fluctuations. For example, if a trader sets a 1% slippage tolerance, the trade will only proceed if the impact stays below 1%, reducing the chance of executing trades with unexpected price impacts.

Price Impact and Slippage on DEXTools

![]() Price Impact and Price Slippage are related but distinct.

Price Impact and Price Slippage are related but distinct.

- Price impact is the change caused by the trade’s size relative to liquidity, while slippage is the difference between expected and actual execution price, often due to market volatility.

- High price impact can increase slippage, leading to unexpected costs.

- On DEXTools, traders can set a maximum slippage tolerance to control for these effects, which means the trade will only execute if the slippage stays within the predefined range. This setting helps prevent unexpected outcomes, particularly during times of high volatility or when trading lower-liquidity tokens.

- In short: Price impact is an essential factor in crypto trading, particularly on Decentralized Exchanges (DEXs). A high price impact can lead to unintended costs, while a low price impact ensures trades are executed closer to the expected price.

![]() DEXTools equips traders with data to manage these impacts effectively, making it easier to navigate both high-liquidity and low-liquidity scenarios.

DEXTools equips traders with data to manage these impacts effectively, making it easier to navigate both high-liquidity and low-liquidity scenarios.

![]() By using tools like DEXTools to monitor liquidity, set slippage, and analyze price trends, traders can make smarter decisions and optimize their strategies in the ever-volatile crypto market.

By using tools like DEXTools to monitor liquidity, set slippage, and analyze price trends, traders can make smarter decisions and optimize their strategies in the ever-volatile crypto market.

And that ‘s it!

Would you like to learn more about concepts to improve your trading, like the ones we just covered in this article? Check out our glossary with over 300 terms right here.

Thank you, and happy trading!