Beginner News

The BALD issue

Let’s talk about Base chain and the $BALD case.

The BALD token’s much-anticipated debut on the Base blockchain has generated a mix of excitement and concern among the crypto community. After a promising start and attracting substantial investment, the BALD token value plummeted dramatically by 90% from its peak on July 31. This sudden decline was reportedly instigated by the token implementer’s withdrawal of millions in liquidity.

Although the token saw a minor recovery, this drastic price swing has raised concerns among cryptocurrency experts who question whether it could be categorized as a “rug pull“, a maneuver where liquidity is abruptly pulled, resulting in huge losses for investors.

What really happened?

Notably, the BALD token briefly achieved a market cap of $50 million, only to surge to $85 million later in just one day, highlighting both its popularity and the inherent risks associated with investing in emerging projects.

On July 29, an individual known by the pseudonym “Bald” publicly declared the launch of the BALD token on the Base network. The token experienced an astonishing 289,000% surge in value within the initial 14 hours of trading. However, on July 31, users on Twitter started reporting that the deployer account of the token had removed 1,034 ETH from its liquidity, leading to a substantial decline in its price, almost reaching zero. This situation has created a commotion in crypto world, and there are even rumours linking this rug pull to Alameda Research and the FTX environment!

How did it all start?

Coinbase’s Base network was initially introduced on July 13 with a focus on builders. However, the development team strongly advised ordinary users not to use the network at this stage due to the lack of a functional user interface for its bridge. Despite these warnings, some investors sought early profits by acquiring assets in the network before its official launch. To do so, they used development tools to bridge the cryptocurrency Ether (ETH).

But… what is Base, exactly?

Coinbase launched its own second-layer (L2) blockchain on Ethereum called Base, aiming to compete in the growing DApps market on the network. Coinbase’s Base network was initially introduced with a focus on builders. With Base, Coinbase can develop its applications and products and foster an open ecosystem for the Web 3 cryptoeconomy, targeting the next billion users. The company announced this development via its Twitter account.

Base is designed as a decentralized, secure, and cost-effective environment for Ethereum application developers. It fully replicates the Ethereum Virtual Machine (EVM) to ensure compatibility. Leveraging the Optimism OP Stack, Base achieves high scalability and interoperability without compromising the security and decentralization of Ethereum’s core network. This makes Base a bridge connecting users to other blockchain ecosystems, thanks to OP Stack’s interoperability features.

What is a Layer 2 network?

A layer 2 network is a system that functions on top of an underlying blockchain protocol, like Ethereum. It conducts transactions separately from the Ethereum mainnet (Layer 1), offering numerous advantages to developers and users, such as enhanced scalability and efficiency, faster transaction speeds, lower gas fees, and maintaining the same level of security and decentralization as the mainnet (Layer 1).

Base’s Layer 2 in particular, intensifies competition in the Ethereum DApps market. Currently, second-layer chains such as Optimism, Arbitrum and Polygon lead the market due to their superior scalability, performance and interoperability.

These solutions benefit users and developers alike by reducing core network commission fees, addressing Ethereum’s major challenge, and making the network more cost-effective. Ethereum’s creator, Vitalik Buterin, has expressed that second-layer networks will shape the future of the mainnet, further validating their importance.

Key features of Base

• Ethereum-backed Security: Base is designed to provide the security and scalability necessary for decentralized apps. It uses Ethereum’s underlying security and incorporates Coinbase’s best practices, allowing a confident transition to Base from Coinbase, Ethereum L1, and other interoperable chains.

• Empowered by Coinbase: Base offers easy access to Coinbase’s products, users, and tools for building decentralized apps. This includes seamless Coinbase product integrations, straightforward fiat onramps, and robust acquisition tools, enabling developers to serve Coinbase’s vast ecosystem, comprising 110 million verified users and $80 billion+ in assets.

• Cost-Effective with Full EVM Compatibility: Base ensures full Ethereum Virtual Machine (EVM) compatibility at a fraction of the cost. It is dedicated to advancing the developer platform by providing gasless transactions for dApps through convenient developer APIs for account abstraction. Additionally, developers can securely build multichain applications using user-friendly bridges.

• Open Source: Base aims to be decentralized, permissionless, and accessible to all, with a vision of establishing a standard, modular, rollup agnostic “Superchain” powered by Optimism. It joins Optimism as a Core Dev on the open-source OP Stack and strives to foster a thriving community of developers.

Finally, how to bridge to Base?

Here you have a detailed guide:

https://docs.base.org/using-base/

To bridge to Base, follow these basic steps:

1. Transfer ETH on the Ethereum Mainnet to the bridge contract address: 0x49048044D57e1C92A77f79988d21Fa8fAF74E97e.

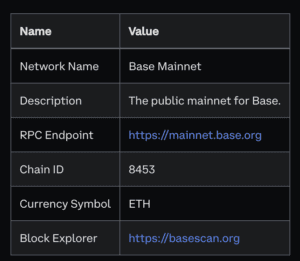

2. Add Base Mainnet by following the instructions provided in the documentation: https://docs.base.org/using-base/

3. Once completed, you’ll receive your bridged ETH on Base. You can trade it on the following platform: https://base.leetswap.finance/#/swapGui

Base mainnet

![]() Please note: currently, there is no way to send the bridged assets back to the Ethereum mainnet, but the bridge back to ETH mainnet will be available soon.

Please note: currently, there is no way to send the bridged assets back to the Ethereum mainnet, but the bridge back to ETH mainnet will be available soon.