General

Conclusion: the doubts will gradually be dispelled.

- In DEXTools we always offer you the best tools and information in real time to help you navigate the crypto market.

- But, for this, it is also important to know a little of what is going on in it. For example, in reference to the influence that Bitcoin has on the cryptocurrency market.

Let’s talk a bit about the Mt Gox case, which has been in the spotlight lately.

The Collapse of Mt. Gox

- Mt. Gox, once the largest cryptocurrency exchange, collapsed in February 2014 after losing 950,000 bitcoins, worth over $58 billion today. The loss was attributed to a bug in Bitcoin’s framework, allowing hackers to illicitly move coins. This marked a significant setback in crypto history, leaving creditors in a long wait for repayment.

- Mt. Gox expedited its distribution from October to July. Delays were caused by bankruptcy and legal challenges. Though the transfer may affect prices, the essential outcome is that victims will finally receive their due compensation.

Mt.Gox recent wallet movements. Source: 99bitcoins.com

The Road to Recovery

- Mt. Gox is about one-third of the way through its repayment plan.

- After years of anticipation, Mt. Gox has begun repaying its creditors. Over 140,000 recovered bitcoins, now valued at around $9 billion, are set to return to their rightful owners. Bitcoin’s price has soared from roughly $600 during the bankruptcy to over $67,000 nowadays. This repayment marks a significant milestone in resolving the Mt. Gox saga.

- Significant transactions include 1,545 BTC to a Japanese exchange and 48,641 BTC to another address. Despite a brief price dip following the initial transfer, BTC has since recovered, currently up 15% from recent lows.

- As of now, 90,344 BTC ($5.77 billion) remains in Mt. Gox’s wallets, waiting to be distributed over the next few months. The median claim per creditor is over four BTC, which, at $500 per coin during the bankruptcy, was only $2,000 but now exceeds $250,000.

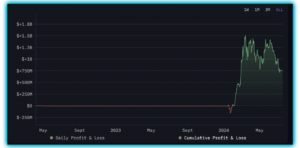

German profits from Bitcoin sales. Source: Arkham Intelligence

Market Impact and Concerns

- Despite the upcoming Mt. Gox repayments, the recovered bitcoin will be readily available for conversion into other cryptocurrencies or traditional fiat currency. In contrast, Germany’s Saxony state sold most of its $2.8 billion in bitcoin through over-the-counter transactions, avoiding direct market impact.

- The repayment process could influence Bitcoin prices as billions of dollars worth of the cryptocurrency re-enter circulation, potentially creating selling pressure. This is compounded by other market factors, such as inflows to exchange-traded funds (ETFs) and the recent Bitcoin halving on April, which we told you about here.

- Analysts have mixed views on the impact. Some believe fears of significant sell pressure are overestimated and unlikely to derail the ongoing rally.

- Unlike forced government sales, Mt. Gox creditors are not compelled to sell, mitigating potential market disruption. However, others estimate a maximum 10% price drop if creditors sell their reclaimed assets in bulk.

- The total sum owed to creditors, approximately 140,000 bitcoins, represents roughly 0.7% of the total 19.7 million bitcoins currently in circulation. Despite potential price impacts, the billions of dollars worth of bitcoin traded daily on trusted exchanges indicate sufficient liquidity to absorb these sales over the summer months.

Conclusion: the doubts will gradually be dispelled.

- Mt. Gox’s repayment saga is a long-awaited chapter in recent crypto history. Its impact on the market remains to be seen, but one thing is certain: the legacy of Mt. Gox continues to shape Bitcoin’s narrative and influence the broader cryptocurrency market.

![]() Are you interested in learning more about the crypto and DeFi markets with its news and terminology? Explore our Academy, where you can find a comprehensive glossary and informative articles. Check them out!

Are you interested in learning more about the crypto and DeFi markets with its news and terminology? Explore our Academy, where you can find a comprehensive glossary and informative articles. Check them out!