General

Analyze Liquidity with DEXTools

- In our recent articles, including this one, we’ve been explaining how to develop optimal trading strategies using DEXTools.

- However, when it comes to cryptocurrency trading, one crucial factor stands out: liquidity.

![]() In the crypto world and Decentralized Finance (DeFi), burned liquidity and locked liquidity are mechanisms used to secure funds in liquidity pools on decentralized exchanges (DEXs) like Uniswap and PancakeSwap.

In the crypto world and Decentralized Finance (DeFi), burned liquidity and locked liquidity are mechanisms used to secure funds in liquidity pools on decentralized exchanges (DEXs) like Uniswap and PancakeSwap.

- These mechanisms are vital for building investor confidence and ensuring project stability.

- Below, we break down the different liquidity pool states, how they work, and how to easily identify them in DEXTools to make your strategy more effective.

1-Locked Liquidity

Locked Liquidity on DEXTools

- Locked liquidity refers to tokens deposited in a liquidity pool that cannot be withdrawn for a set period or for a long time. This process uses smart contracts to lock funds, preventing project creators or others from accessing or manipulating liquidity before the agreed timeframe.

- Locking liquidity is a security measure designed to prevent rug pulls where creators withdraw liquidity suddenly, causing the token’s value to collapse and leaving investors with worthless assets.

Example

- A developer launches a token and adds liquidity (e.g., TOKEN/ETH) to a pool on Uniswap. To reassure investors, they use a liquidity-locking service like DxLocker or Unicrypt, locking the tokens for one year. During this time, no one can access or withdraw the funds.

Benefits

- Increases investor confidence by ensuring funds can’t be withdrawn unexpectedly.

- Protects against rug pulls by preventing developers from pulling liquidity abruptly.

Drawbacks

- If the project fails, the funds remain locked until the period expires, leading to temporary loss of liquidity.

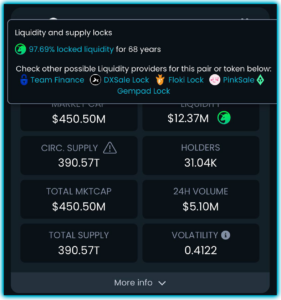

![]() How to identify locked liquidity on DEXTools:

How to identify locked liquidity on DEXTools:

- On DEXTools, you can check if a project has locked liquidity by reviewing the pool information section.

- It will clearly display the liquidity status and the time remaining until it unlocks. This feature allows investors to quickly assess the security of their funds.

2. Burned Liquidity

Burned Liquidity on DEXTools

- Burned liquidity takes things further. In this case, liquidity tokens are permanently burned, meaning they are sent to an inaccessible wallet (a ‘burn address’) and can never be retrieved.

- While this means that the burned liquidity cannot be withdrawn, it does not necessarily make the liquidity pool itself permanent.

- This approach increases investor confidence by eliminating the possibility of withdrawal, but developers lose control over the burned funds.

Example

- When a project burns its liquidity tokens, they cannot be retrieved. Even if the project needs to adjust the pool, the funds remain inaccessible.

Benefits

- Offers absolute confidence to investors by eliminating the possibility of withdrawal.

Drawbacks

- Inflexibility, as the burned liquidity cannot be accessed.

In summary:

- Liquidity locks are temporary, released after a set period, while burned liquidity is permanent and cannot be withdrawn.

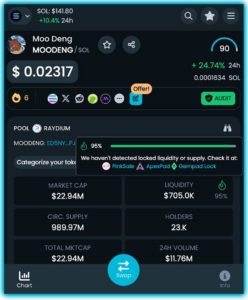

![]() How to identify burned liquidity on DEXTools:

How to identify burned liquidity on DEXTools:

- On DEXTools, the locked or burned liquidity percentage is visible directly in the pool information without the need to click further, making it extremely efficient when using the app or mobile version.

- This feature helps you quickly evaluate the project’s liquidity status from any device.

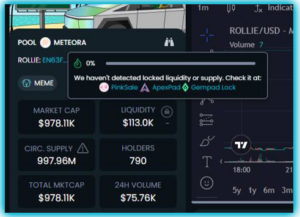

Locked Liquidity still not detected on DEXTools

3-Unlocked Liquidity

- In the crypto world, unlocked liquidity refers to the percentage of tokens in the pool that are neither burned nor locked up. This means that these assets are fully accessible and can be freely traded, transferred, or used without any constraints or limitations.

- Essentially, it’s the liquidity that is readily available for transactions and may pose a rug pull risk.

- And that’s it! Now you know a bit more about how liquidity works in crypto. We hope this helps with your strategy.

- Don’t forget to check out our extensive glossary to familiarize yourself with key crypto and DeFi terms.

Thank you, and trade safe!