GeneralTop 5 DEXTools Indicators for DeFi Traders

Top 5 DEXTools Indicators for DeFi Traders

- Once again, we’ll explain how to make the most of your DeFi trading with DEXTools, as we’ve been doing in our recent articles. This time, we’ll introduce 5 indicators for novice traders. Don’t hesitate to discover them and try them out for yourself!

- Are you looking to up your game in DeFi trading? DEXTools is a powerful platform that helps traders navigate decentralized exchanges (DEXs) with real-time insights and advanced metrics.

- Whether you’re new to trading or looking to sharpen your strategy, here are the Top 5 DEXTools indicators that expert traders rely on to analyze price behavior and spot the best market opportunities.

1. DEXTscore

DEXTscore and Audits on DEXTools

- The DEXTscore is a comprehensive rating system that evaluates tokens based on several factors like trading volume, liquidity, and community activity.

- This score helps you quickly assess a token’s credibility and overall health before diving into a trade.

- A high DEXTscore usually indicates a reliable project with consistent activity, while a low score could be a red flag for newer, less-established tokens.

![]() Tip for newbies: Start by trading tokens with a higher DEXTscore to minimize risk while learning the ropes.

Tip for newbies: Start by trading tokens with a higher DEXTscore to minimize risk while learning the ropes.

2-Audits

Audit Scan on DEXTools

- Audits are essential for assessing the security of smart contracts behind a token. DEXTools shows whether a token has been audited by reputable firms, which is critical for identifying safe investments in a space notorious for scams and hacks.

- An audit report will highlight vulnerabilities or risks within the token’s code, providing you with a clearer picture of its security.

![]() Tip for newbies: Avoid tokens without audits or with unresolved issues in their audit report.

Tip for newbies: Avoid tokens without audits or with unresolved issues in their audit report.

3. Liquidity

Liquidity on DEXTools

- Liquidity is the amount of available funds for a token in its trading pool. In DeFi trading, liquidity is crucial because it impacts how easily and quickly you can buy or sell tokens without significant price fluctuations.

- Tokens with higher liquidity tend to be more stable and are less prone to large price swings caused by single trades. On DEXTools, you can see both the current liquidity levels and how they’ve changed over time.

- In this recent article, we explain in detail everything about liquidity and how to analyze it.

![]() Tip for newbies: Stick to tokens with robust liquidity to avoid slippage and ensure you can exit a position when needed.

Tip for newbies: Stick to tokens with robust liquidity to avoid slippage and ensure you can exit a position when needed.

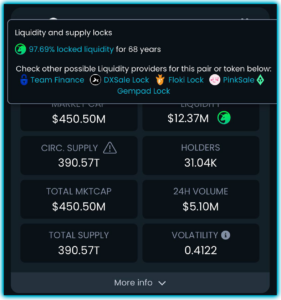

4. Liquidity Locks & Burns

Liquidity Locks on DEXTools

- Liquidity locks refer to tokens whose liquidity has been “locked” in a pool for a set period, meaning the project developers can’t remove those funds prematurely.

- This reduces the risk of a rug pull, where liquidity is drained, and the token’s price collapses. Similarly, token burns—where tokens are permanently removed from circulation—can indicate a deflationary model that may increase token value over time.

- The DEXTools token, $DEXT, is an example of a well-designed and useful deflationary token. In this article, we talk about the latest token burns. And in this Dashboard, you can get detailed information about the entire process!

![]() Tip for newbies: Look for tokens with long-term liquidity locks or regular burns to ensure the developers are committed to the project.

Tip for newbies: Look for tokens with long-term liquidity locks or regular burns to ensure the developers are committed to the project.

5. Market Cap & Supply

Charts by Marketcap on DEXTools

- Market capitalization (Market Cap) is the total value of a token, calculated by multiplying the current price by the total supply. A token’s market cap is a good indicator of its scale and potential.

The supply can be divided into three categories:

- Circulating supply: tokens currently available for trading.

- Total supply: all tokens in existence.

- Max supply: the total amount that will ever exist.

- The relationship between market cap and supply is important. A higher market cap often indicates a more established and stable project. Changes in supply can greatly impact market cap, influencing the perceived value and stability of a cryptocurrency and guiding investors in their decisions.

![]() Tip for newbies: Start with mid to large-cap tokens as they generally provide a safer entry point while you’re still learning.

Tip for newbies: Start with mid to large-cap tokens as they generally provide a safer entry point while you’re still learning.

- And that’s all. By mastering these five key DEXTools indicators—DEXTscore, Audits, Liquidity, Liquidity Locks & Burns, and Market Cap & Supply—you can significantly improve your DeFi trading strategy.

- Focus on high-quality, secure tokens and understand the basics of liquidity and market cap to minimize risk and maximize opportunities.

![]() Remember: this is not investment advice, and investing carries risks. We encourage you to educate yourself thoroughly before making any decisions. Don’t forget: DYOR (Do Your Own Research).

Remember: this is not investment advice, and investing carries risks. We encourage you to educate yourself thoroughly before making any decisions. Don’t forget: DYOR (Do Your Own Research).

You can rely on our Academy on our website as well as our YouTube channel for helpful resources.

You can rely on our Academy on our website as well as our YouTube channel for helpful resources.

We thank you for your support and encourage you to join our huge community on Telegram.

We thank you for your support and encourage you to join our huge community on Telegram.

Happy trading!