General News

A leap forward for DeFi efficiency

Uniswap V4, the latest iteration of the decentralized exchange (DEX) pioneer is a leap forward for DeFi efficiency. It marks a significant advancement in DeFi landscape compared to its predecessor, V3, which was released in May 2021.

Uniswap V4 brings forth an array of enhancements that redefine the DeFi experience. This article explores the key improvements of Uniswap V4, with a focus on two game-changing features: Hooks and Singleton, and their potential to propel DeFi into a new era of limitless possibilities.

Staying True to DeFi Principles

Uniswap’s iterative upgrades have consistently demonstrated the boundless potential of the DeFi realm while adhering to its core principles emphasizing the importance of customizable trading logic, enhanced gas efficiency, improved developer experience, and streamlined transaction processes.

In comparison to V3, both developers and users stand to benefit from a more open, adaptable, and efficient AMM service!

Exploring Uniswap V4 Upgrades: Hooks and Singleton

Game-Changing Introduction: Hooks

- At the heart of Uniswap V4 lies its groundbreaking feature: Hooks. Hooks empower developers to craft their unique DEX tailored to specific scenarios, effectively transitioning DeFi from the “Lego era” to an era where the possibilities are limitless. Hooks function as plugins for customizing liquidity pools, exchanges, fees, and interactions with liquidity providers (LPs).

- Developers can execute specific actions at pivotal points in a liquidity pool’s lifecycle, such as before or after a swap or LP position change.

- Hooks are also smart contracts that interact with Uniswap V4’s core contracts, allowing execution at various “key points” within a liquidity pool. Developers can thus define and execute custom logic in a flexible manner, giving them control over a pool’s behavior and interactions. This innovation opens doors to creative opportunities, including support for Time-Weighted Average Market Making (TWAMM) strategies, dynamic fee adjustments, on-chain limit orders, and seamless integration with lending protocols.

Singleton: A Paradigm Shift in Efficiency

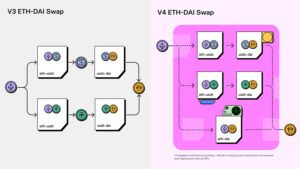

- Uniswap V4 revolutionizes contract architecture by replacing the Factory-Pool model used in previous versions with a Singleton structure. In V3, each liquidity pool creation required a new contract deployment, incurring substantial costs. V4 addresses this issue by consolidating all liquidity pools into a single contract.

- This breakthrough minimizes gas consumption for creating liquidity pools and cross-chain contracts, eliminating the need for token transfers between different contracts during swaps. The result? Up to a remarkable 99% reduction in gas fees compared to V3!

- Additionally, Uniswap V4 introduces the “Flash Accounting” system, optimizing asset transfers by only adjusting the “net balance”. Each operation (swap/deployment) affects the internal balance through a unit called “delta”, leading to a more efficient system with significant gas savings. This architecture also enables direct trading with Ether (ETH), enhancing transaction convenience and reducing gas fees.

Comparison between the V3 and V4 swap versions.

Advancements in Contract Structure and Liquidity Management

Uniswap V4 adopts a fresh approach to the storage and encapsulation of liquidity positions. While V2 employed homogeneous tokens (ERC-20) to represent liquidity positions distributed across the entire range, V3 introduced non-fungible tokens (ERC-721) for concentrated liquidity. In V4, liquidity positions are speculated to be managed based on wallet addresses, offering further cost optimization.

Custom Oracle Implementation and MEV Distribution

Custom Oracle Implementation and MEV Distribution

Uniswap V4 strives to enhance the trading experience by implementing a custom Oracle mechanism and an internalized Miner Extractable Value (MEV) distribution system. These steps can include designing a custom Oracle to provide tailored price data, integrating the Oracle and MEV distribution into Uniswap V4’s smart contracts, and creating mechanisms for notification and incentives for liquidity providers.

The Advantages of Customized Liquidity Pools

The Advantages of Customized Liquidity Pools

Uniswap V4 introduces the concept of customized liquidity pools, revolutionizing the DeFi landscape. By building upon centralized liquidity, this shift provides multiple benefits, including expanded options for liquidity providers, reduced costs, improved efficiency, a wider range of trading strategies and risk management tools, as well as enhanced flexibility and creativity.

A controversial idea

A heated debate has sparked within the Uniswap DeFi community following the proposal to introduce a Know Your Customer (KYC) verification process.

- The incorporation of KYC in Uniswap could have significant impacts on its operation and adoption. On one hand, it could attract institutional investors and improve the overall perception of cryptocurrencies, potentially increasing liquidity and trust in the platform. Additionally, KYC could help prevent illegal activities such as money laundering and terrorist financing, which could benefit both users and regulators.

- However, the implementation of KYC also poses significant challenges. It might restrict access to Uniswap, affecting users who value privacy and decentralization. Furthermore, it could raise concerns about the security and handling of users’ personal data.

Conclusion: Uniswap V4’s Impact on DeFi’s Future

Uniswap V4 is a monumental leap forward for DeFi efficiency, introducing Hooks and customizable liquidity pools that offer unprecedented flexibility and creative opportunities within the DeFi ecosystem. This transformation has the potential to reshape the DeFi landscape, allowing developers to harness substantial liquidity for their ecosystems while empowering users with innovative, personalized trading experiences. The synergy of Hooks and Singleton, combined with the efficiencies of Curve and Camelot, may very well influence the future development trends of DeFi, fostering a new era of limitless possibilities.