News

PayPal announces its stablecoin known as PYUSD (PayPal USD), an ERC-20 token supported by the US dollar. This move establishes PayPal as the first major financial company to release a stablecoin!

How does it work?

- PayPal’s stablecoin, PYUSD (PayPal USD), is set to serve as a means for payments and transfers, initially targeting PayPal’s customers within the United States. Developed by Paxos Trust Co., PYUSD will be linked to the US dollar and fully supported by deposits in US dollars, short-term Treasuries, and equivalent cash assets.

- As highlighted in PayPal’s official announcement, eligible users of the platform will have the opportunity to acquire PYUSD. They can also take advantage of various functionalities such as transferring funds between PayPal and compatible external wallets, conducting peer-to-peer transactions using PYUSD, using PayPal USD to make purchases at the checkout, and converting supported cryptocurrencies to and from PYUSD.

- PayPal’s introduction of PYUSD represents a significant leap in the cryptocurrency domain. This move has the potential to encourage other financial institutions to adopt similar approaches, given PayPal’s extensive user base of hundreds of millions spanning 200 markets. Nevertheless, the extent of PYUSD’s adoption among PayPal’s clientele remains to be seen.

- PayPal has announced that Paxos will release monthly reports that provide comprehensive information about the asset backed by PYUSD, beginning from the upcoming month. Additionally, Paxos intends to share external public endorsements of the value of its novel stablecoin reserve asset.

- Considering the intensified regulatory measures being imposed on the cryptocurrency sector in the United States, this action by Paxos could be perceived as a daring step, particularly given the fact that the company recently initiated legal proceedings with the SEC in the middle of February. This development also pertains to Binance’s stablecoin (BUSD) within this year.

![]() The incorporation of PYUSD as an ERC-20 token on the Ethereum blockchain holds substantial value. It offers the advantage of seamless integration with exchanges and will enhance various functionalities within the PayPal ecosystem.

The incorporation of PYUSD as an ERC-20 token on the Ethereum blockchain holds substantial value. It offers the advantage of seamless integration with exchanges and will enhance various functionalities within the PayPal ecosystem.

![]() This strategic decision reinforces PayPal’s standing within the cryptocurrency sphere, building upon its initial foray into crypto services in 2020. The company initially facilitated the buying, holding, and selling of cryptocurrencies for users, subsequently introducing the innovative “Checkout with Crypto” feature tailored for online transactions.

This strategic decision reinforces PayPal’s standing within the cryptocurrency sphere, building upon its initial foray into crypto services in 2020. The company initially facilitated the buying, holding, and selling of cryptocurrencies for users, subsequently introducing the innovative “Checkout with Crypto” feature tailored for online transactions.

A stablecoin with some flaws

![]() A crypto stablecoin is a type of digital currency designed to maintain a relatively stable value, often pegged to a traditional asset like a fiat currency (e.g., US Dollar) or a commodity. It offers the benefits of cryptocurrencies, like fast and borderless transactions, while minimizing price volatility seen in other cryptocurrencies like Bitcoin.

A crypto stablecoin is a type of digital currency designed to maintain a relatively stable value, often pegged to a traditional asset like a fiat currency (e.g., US Dollar) or a commodity. It offers the benefits of cryptocurrencies, like fast and borderless transactions, while minimizing price volatility seen in other cryptocurrencies like Bitcoin.

Stablecoins are used for trading, remittances, and as a store of value in the crypto ecosystem, providing a bridge between the digital and traditional financial worlds. Popular examples include Tether (USDT), USD Coin (USDC), and DAI, which aim to maintain a 1:1 value ratio with their respective fiat counterparts.

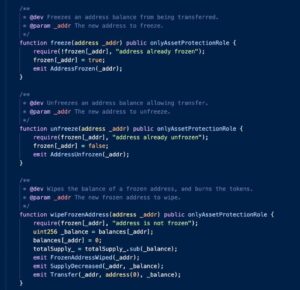

![]() All stablecoins, new or not, have certain weaknesses in their design, so you have to be careful and DYOR. Recently, some users have analyzed the PYUSD contract code and have found certain red flags in it. But USDT and USDC, for instance, can blacklist your address, which means that funds cannot be moved from that moment: it is blocked. On the other hand, PYUSD can move tokens and clear the balance of any address.

All stablecoins, new or not, have certain weaknesses in their design, so you have to be careful and DYOR. Recently, some users have analyzed the PYUSD contract code and have found certain red flags in it. But USDT and USDC, for instance, can blacklist your address, which means that funds cannot be moved from that moment: it is blocked. On the other hand, PYUSD can move tokens and clear the balance of any address.

PayPal’s PYUSD can be frozen. Trade safe and DYOR.

More info here:

https://www.paypal.com/us/digital-wallet/manage-money/crypto/pyusd

You can learn everything about stablecoins in our article on the subject, here:

First Digital Launches FDUSD: let’s talk about Stablecoins. | DEXTools