General

Trump’s Tariffs and the Impact on Crypto: 2025 Market Outlook

The cryptocurrency market has experienced considerable fluctuations in recent weeks, particularly in response to Donald Trump’s announcement of new tariffs.

- Despite the latest news, the crypto market always fluctuates to some extent, and in reality, it’s essential to stay prepared and not be swayed by FUD (Fear, Uncertainty, and Doubt).

- Don’t forget that at DEXTools, we offer you the best trading tools, constantly improving and updating them.

You can access DEXTools Dashboard here:

https://www.dextools.io/app/en/hot-pairs

And now, let’s talk about what’s happening in the crypto market.

1 Yr BTC vs U.S Dollar evolution (Source: TradingView)

Tariffs, Trade Wars, and Crypto Volatility

- The most recent announcement of a 25% tariff on imports from Mexico and Canada, along with a 10% tariff on Chinese imports, sent shockwaves through the market. Bitcoin (BTC), Ethereum (ETH), and several altcoins suffered significant losses.

- Initially, Trump’s policies sparked optimism among crypto enthusiasts, with the potential for a U.S. strategic cryptocurrency reserve and a pro-crypto summit at the White House. However, this optimism was short-lived.

- Bitcoin dropped by 10%, falling to $83,000, after briefly surpassing $93,000 within a 24-hour period. Ethereum also saw a 12% loss, falling below $2,100.

- The altcoins weren’t spared either—XRP dropped by 13%, Solana (SOL) lost 15% and Cardano (ADA) was down by 18%.

The question remains: how will these dynamics affect the broader cryptocurrency market in the long term, particularly as we look toward 2025?

Crypto Total Market Cap excluding BTC (Source: TradingView)

Reaction to Trump’s Crypto Reserve Announcement.

- Two posts by President Donald Trump outlining his plans for a US crypto reserve sparked a broad market rebound on March 2, driving global crypto market capitalization up nearly 7% to $3.04 trillion.

- A US crypto reserve could encourage institutional investment, but concerns persist over its structure, regulation, and volatility.

Crypto Market’s Response to Economic Uncertainty

- Despite the early optimism surrounding Trump’s policies and his apparent support for cryptocurrencies, the market has remained highly volatile. Investors have been torn between the potential long-term benefits of Trump’s pro-crypto stance and the immediate negative impact of economic uncertainty, particularly regarding tariffs.

- Wall Street’s reaction further underscores the fragile nature of the current market conditions. The technology sector, in particular, experienced substantial losses, with companies like Nvidia facing significant declines.

Looking Ahead to 2025: The Future of Crypto ETFs and Stablecoins

- The U.S. Securities and Exchange Commission (SEC) is expected to provide clearer guidelines regarding cryptocurrency exchange-traded funds (ETFs) by 2025. This regulatory clarity is crucial, as it will enable a smoother approval process for new ETFs, reducing uncertainty in the market.

- Another major trend to watch is the continued rise of stablecoins, which are projected to play a critical role in the crypto market by 2025. Stablecoins, such as Tether (USDT) and USD Coin (USDC), are expected to reach a market of $400 billion by 2025.

Other Emerging Trends: AI, Tokenization, and Environmental Finance.

In addition to stablecoins, there are several other trends that could reshape the crypto landscape by 2025.

- One of these is the rise of AI-driven agents in the crypto market. These autonomous programs will help investors optimize their strategies, providing real-time analysis of market conditions and facilitating efficient transaction execution.

- Another exciting development is the tokenization of real-world assets, such as real estate, fine art, and even commodities via NFTs. By converting physical assets into digital tokens, the blockchain can improve liquidity and accessibility.

- Furthermore, environmental finance (ReFi) projects leveraging blockchain technology are expected to grow in prominence.

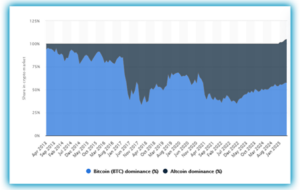

BTC vs Altcoins Dominance (Source: statista.com)

The Path Forward for Cryptocurrencies

- Looking ahead to 2025, the cryptocurrency market is likely to continue its volatile journey, influenced by both geopolitical factors and emerging technological innovations.

- The coming years will be critical for the continued evolution of the crypto market. While the short-term impact of tariffs and economic uncertainty remains a concern, the broader trajectory for cryptocurrencies is promising.

And that ‘s it!

To navigate the complex world of crypto and its terminology more easily, we recommend checking out our extensive glossary with over 300 terms.

https://info.dextools.io/crypto-glossary/

You can also join our Telegram community here to stay up to date with everything:

Telegram: Contact @DEXToolsCommunity

Thank you and happy trading!

Disclaimer: This article is for informational purposes only. DEXTools does not provide investment advice. Always conduct your own research (DYOR) before making financial decisions.

Disclaimer: This article is for informational purposes only. DEXTools does not provide investment advice. Always conduct your own research (DYOR) before making financial decisions.